BUSINESS LICENSE REGIMES

PRIMARY LICENSES.

The primary license you will need after either registering a business name, incorporating a company, or registering a foreign company in Uganda is the Tax Identification Number granted only by the Uganda Revenue Authority.

Where the business is a sole proprietorship, the tax identification number is that of the business owner.

Where the business is a limited liability partnership, general partnership, or joint venture then the underlying business partners or owners will need to first apply for personal or company tax identification numbers before the front business can be granted a tax identification number.

Where the business is an incorporated company or a registered foreign company, then one director must have a personal tax identification number as a contact and reference person of the company.

It’s important that the company has a generally accessible email that will henceforth be used as a contact email address for all tax notifications.

All tax heads, including Income tax, Value Added Tax, Excise Tax, and Import duty, among others will be assessed through the granted tax identification number.

Note: from the onset of tax identification number registration, it’s advisable to engage an accounting and audit firm with certified public accountants in Uganda.

WITHOUT a tax identification number, you will not be able to acquire any trading license.

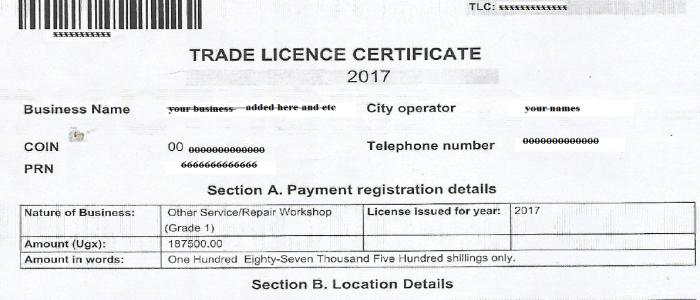

TRADING LICENSES!

The trading license regime is twofold, depending on the kind of business you undertake.

Unregulated businesses; will generally require a trading license from the district administration where the business is located. The fees payable as the trading license will depend on a business grading, determined by the nature of the business undertaken and the actual location of the business.

Regulated businesses; such as financial institutions, telecoms, couriers, media, managed funds, charities, not-for-profit organizations, travel agencies, clearing, and forwarding among many are granted trading licenses by authorized government organs.

WORK PERMITS!

Foreign nationals; all foreign nationals must have valid work permits to work in Uganda or in order to run their businesses in Uganda. The work permits granted will depend on whether you are a business owner or an employee.

Some of the significant preconditions for work permits are, having a fully registered business, a tax identification number with nill tax liability, a business location, a trading license, and sufficient capital investment or cash, not less than 10,000 USD.

Uganda Revenue Authority -Tax Identification Number

Unregulated Business or Regulated Business Trading Licenses

Work Permits – Business Owner and Employees

hands on experience

we know our way around things